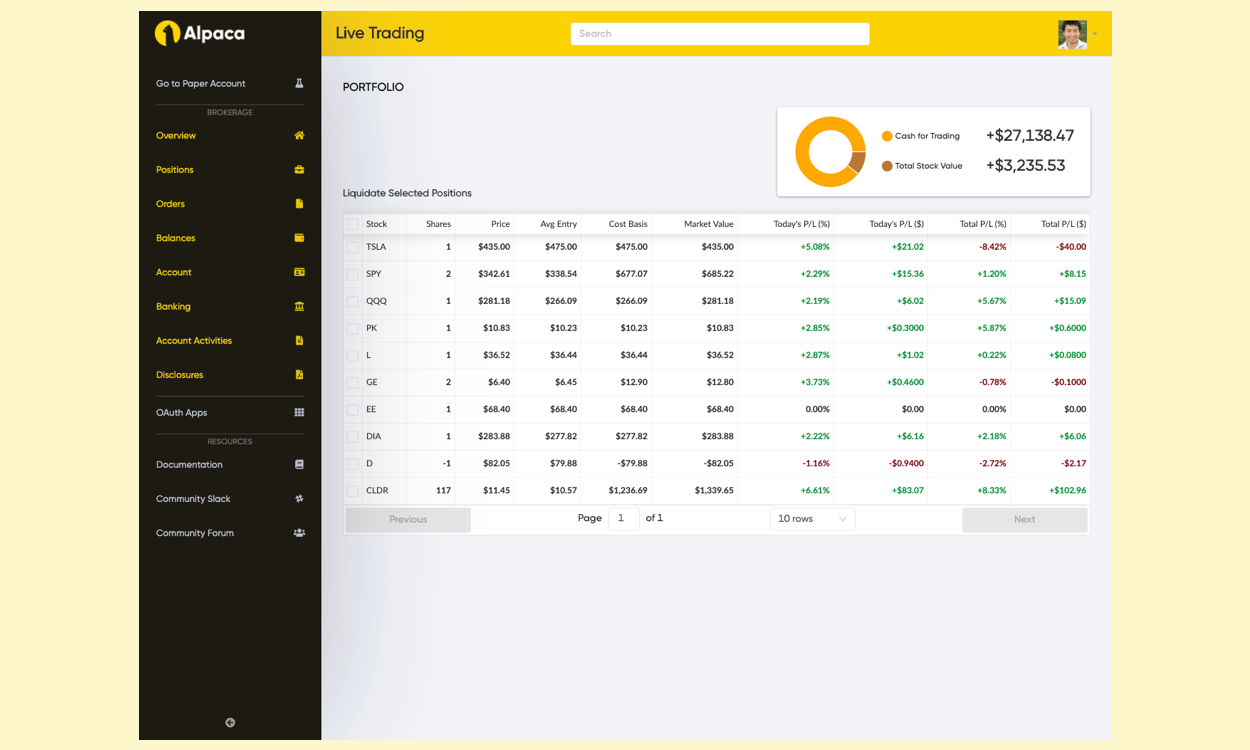

These new features are to offer more flexibility when using Alpaca products and are to give you more visibility on the web-dashboard as well.

Tag: algo trading

Total 15 Posts

Announcing TradingView OCO & Tradetron launch on Alpaca. Alpaca continues to add the integration partners.

Letting you know that we have started an invite-only beta program for non-US resident Alpaca users to open live-trading accounts ✌️.

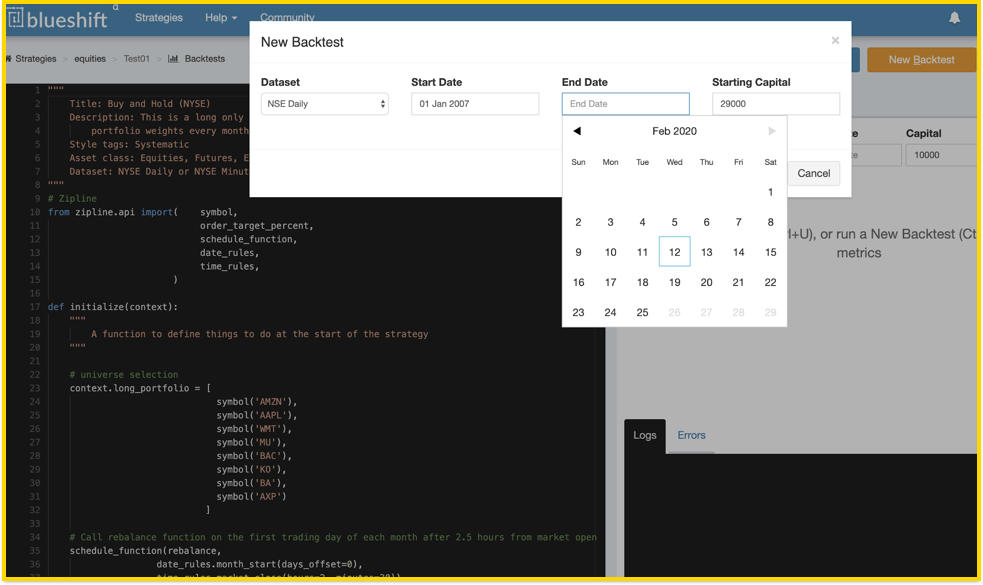

A leading quant finance school QuantInsti and Alpaca team up to offer a super seamless experience in algo trading through Blueshift integration with Alpaca commission-free trading API

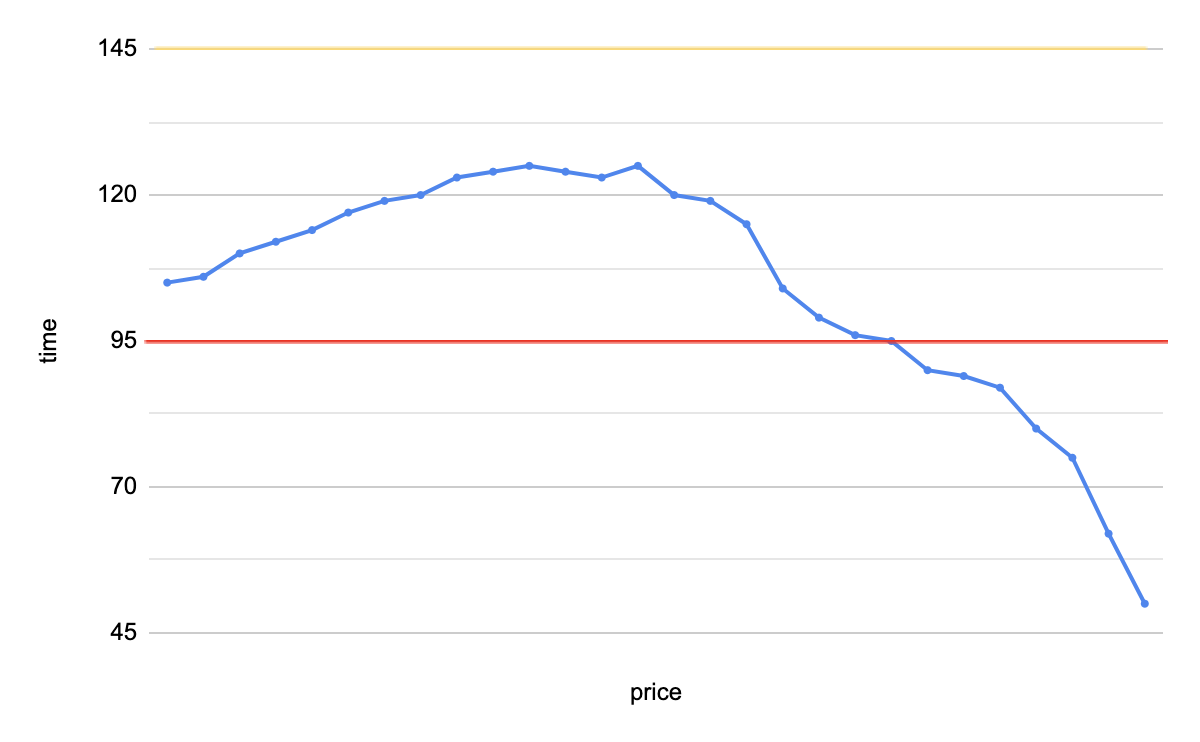

Trying to stay within a target price range while stock trading? Alpaca is here to help with all-new bracket order functionality.